1. Avoid Evil Overdraft Monster

But, and here's the thing I've been sitting on for a while now. In the process of making these goals, I had to take a good hard look at how much my financial mistakes have cost me. And it's pretty damn shocking. So, please try not to judge me too harshly when I reveal the numbers:

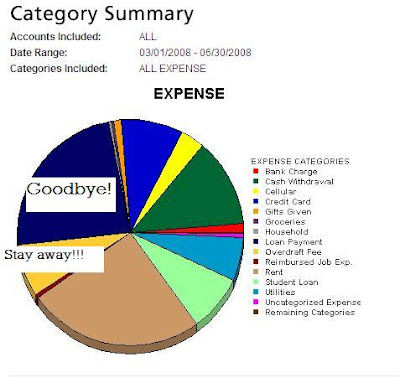

This chart shows how my money has been spent from March 13 (the earliest I could look up online) to today. And it includes:

$2,375 in LOAN repayment. $100 of which was repaid to Friend A. $240 I eventually got back. But I did end up paying a grand total of $2035 to Payday Loans in three months time. And it's FINALLY OVER. My last payment posted on Friday. I am so happy I finally got out of the disastrous cycle. Now, I will have SO much more money to devote more wisely each month.

I also managed to avoid the Evil Overdraft Monster fees at my bank. Something that I've paid, wait for it, $741 to since March 13th, representing 7.41% of my spending. $741! That's more than a month's rent down the drain. Never again!!

Now that I have finally been released from the shackles of payday loans and regular bank overdrafts I am looking forward to planning a Master Budget that's more realistic and building an Emergency Fund so I never have to borrow money again!

3 comments:

You sure did rack up quite a bit of overdraft charges. At least you're starting to pay attention to you can avoid the balance dropping below $0. I'm also happy for you that the payday loan nightmare is finally over. I think you will have some money to finally get down to business and pay back debt/bring everyone current. Where did the chart come from?

My bank's web site lets you do "budget management" and categorize every transaction and then track those categories over time. It's a really useful tool to help me get out of "head in the sand" mode to actually seeing where my money is going. I can't wait to get current on everything else now!

Sallie, I'm also a notorious overdraft fee person. Even last week I went into overdraft due to a mistake in my calculations. I'm right there with you in the fight against the evil fee monsters.

If I added up all the over the credit limit fees and late fees I've paid in the 10 years since I was first exposed to credit, it would probably make me sick. So, I look forward to savings and not fees! Great job, I love your blog.

Post a Comment