Wednesday, December 10, 2008

Where It Went 11/26-12/09

Wednesday, November 12, 2008

Where it Went 10/29-11/11

Thursday, September 18, 2008

Oh No, a Bank Robbery!!

Remember those chicks who robbed the bank and were caught laughing about it on camera? I feel like applauding them right now. Well, not really. But my bank has robbed me of $80. It's going to give it back, but still, it's annoying. Here's what happened:

Remember those chicks who robbed the bank and were caught laughing about it on camera? I feel like applauding them right now. Well, not really. But my bank has robbed me of $80. It's going to give it back, but still, it's annoying. Here's what happened:

Despite my deposit of $580, the bank has decided to only credit my account $499 worth. According to the woman on the phone the rest should be available tomorrow. I had half a mind to walk to the bank again today and just deposit the $12 or so I need to buy the plane ticket, but I was too busy all day.

Wednesday, July 9, 2008

Budget 07/09 - 07/22

Starting Balance = 1226

Good old Aunt Sallie - 406

Job Expense - 65 (included in last budget but still has not cleared, sigh)

Transfer to Other Checking Account - 200

Lab fees from my physical - 12

Nice Collection Agency - 125

Boyfriend Debt Payoff - 300

Left over for ME = 118. Actually it's a little more, let me explain.

So a while back I explained how my Dad will occasionally deposit money into another bank account that I have. It's nice definitely, but it made me not exactly mindful of what was going on in that account. Lo and behold, the balance has plumetted to NEGATIVE $119!!! Yup, I was smacked with the Evil Overdraft Monster. I've known about this for the past couple of days and was struggling to find a way to prevent it from happening but there was no money falling out of the sky so alas, I'm dealing with it now. But I have made sure it won't happen again - I QUIT THE GYM. It was a little depressing to go into the gym and fill out the paperwork but when you don't have money in your account, the $46 a month gym membership costs you.....$78!! I do like the gym and when I'm in the swing of things I go to an abs class a few times a week on my lunch break. But seeing that negative balance and knowing that this is not the first time this has happened prompted me to action.

So, anyway, pardon my long explanation, but I will have an additional $80 in that account that I can spend if need be. It does look like I'm going to have to hold off on buying my Sister's wedding gift until the next pay period. Sigh.

I am very excited to report that tomororw when he gets home from traveling, Boyfriend will be $300 richer (and I'll be $300 poorer)!! I'm happy that I'm finally able to pay off this debt to him. He has been really understanding about it this whole time but still I felt like a loser. I can't wait to update my sidebar!!

Monday, June 30, 2008

Independence Day Comes Early!!!

1. Avoid Evil Overdraft Monster

But, and here's the thing I've been sitting on for a while now. In the process of making these goals, I had to take a good hard look at how much my financial mistakes have cost me. And it's pretty damn shocking. So, please try not to judge me too harshly when I reveal the numbers:

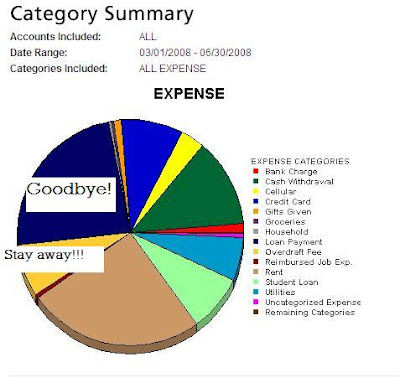

This chart shows how my money has been spent from March 13 (the earliest I could look up online) to today. And it includes:

$2,375 in LOAN repayment. $100 of which was repaid to Friend A. $240 I eventually got back. But I did end up paying a grand total of $2035 to Payday Loans in three months time. And it's FINALLY OVER. My last payment posted on Friday. I am so happy I finally got out of the disastrous cycle. Now, I will have SO much more money to devote more wisely each month.

I also managed to avoid the Evil Overdraft Monster fees at my bank. Something that I've paid, wait for it, $741 to since March 13th, representing 7.41% of my spending. $741! That's more than a month's rent down the drain. Never again!!

Now that I have finally been released from the shackles of payday loans and regular bank overdrafts I am looking forward to planning a Master Budget that's more realistic and building an Emergency Fund so I never have to borrow money again!

Thursday, May 29, 2008

Thank Goodness I Can Eat Now!!!

I'm tempted to throw $50 towards Utilities just so I could knock that out faster but I think I will wait at least until I've made it much closer to the end of my 13 day waiting period.

I am officially allocating $21 towards taking the train to my Sister's Bridal Shower #2 next weekend.

Stay tuned for a long rant on Payday Loans very soon!

Monday, May 19, 2008

Got My Money Back!

I had to pay $315 TWICE to my landlord a couple of weeks back. It was money that I owed him. Problem was: I wrote out a money order so that my check wouldn't bounce and HE LOST IT. It was my fault. I didn't tell him I was putting it in the envelope with the rent check so he didn't see it I guess. I went to the bank to see about cancelling it and they told me it would take 90 days to get it back. Frustrated, I just waited for the next pay period and paid him again, figuring I would wait the 90 days for the money to be returned to my account.

Well this weekend he calls and says HE FOUND THE MONEY ORDER. I was extremely happy to hear this. Took it to the bank this morning and boom, $315 back in my account.

Alas, it was needed as I have taken out $100 in cash since Thursday and still hadn't paid my student loans. And another payday loan that I must have forgotten about went through and I'm out another $65.

It's embarrasing that I am this bad with money. It really is. But I'm glad the money is back in the account. I promptly paid $100 to my student loans this morning and now will have enough to cover the $300 settlement I made to a Collection Agency that hasn't hit the account yet.

Luckily I can't eat any solid foods or smoke this week so I'm going to be pretty much spend free for the next couple of days.

Monday, May 12, 2008

Online Banking - Or Else!

AND I learned I can only SPEAK to a Customer Service Representative three times a month or I incur another fee. How's that for service? I hate banks!

Friday, May 9, 2008

"You have excellent credit history"

This means I can devote $100 to paying off the balance of the OTHER Payday loan I took with another company at the end of April ($350 borrowed, $455 owed). If I pay the finance fee plus $100, I am pretty sure I can knock off the balance by 5/29, my next due date.

Organization is key to debt management I realize. Sallie's Niece of the past would get so discouraged that she would go days without checking her account balances for fear of getting depressed. The overdrafts, finance fees, late fee, etc. would add up. The new Sallie's Niece is going to know exactly how much she owes, to whom, and when it is due at all times.

I didn't spend any money at all yesterday except for the soda from the vending machine. Went home for lunch (had a pitiful chicken noodle soup but oh well, my parents gave me like a case). So I still have $20 cash on hand and $27 in the bank. It's hard to get encouraged by this pitiful balance but at least I know where it is!

Thursday, May 8, 2008

No More Bank Fees!!!

As much as I felt for her situation (hey I've been there more times than I care to admit) it helped to know I wasn't not alone. I found this article on The Street today talking about how banks are now relying on fees to make a profit.

My friend was so frustrated that she ended up opening an account at a local credit union. This is problematic for her, however, as she works in a different state and is in the process of moving slightly closer to work (though she's not sure what town yet) and now has to figure out where she's going to move AND what bank suits her needs best.

I told her if she has a good experience with the credit union I may join as well but my current bank is very convenient for me right now (branches close to work and home). I've also resolved to keep vigilant track of my account balance so that I never get overdrafted again!